Generating consistent income through intelligent trading strategies remains one of the most sought-after goals for traders and investors alike. Whether you are a seasoned trader or a novice seeking opportunities in the options trading market, the SPX Income Program offered by InsideOptions provides a streamlined and expert-driven approach to help you harness the power of SPX credit spread strategies. In this comprehensive guide, we will delve into the mechanics of the SPX Income Program and explore the key components of a successful SPX credit spread trading strategy, enabling you to optimize your trading experience and unlock the potential for consistent income generation.

Embarking on this journey, we will unveil the essentials of credit spread strategies, specifically focusing on SPX options trading. By assimilating proficient guidance and utilizing the state-of-the-art tools provided by InsideOptions, you can successfully navigate the ever-evolving options trading landscape with precision and conviction. Our dedicated team of professionals is eager to support your trading journey, driving efficiency and accuracy in your approach to SPX credit spread strategies.

From understanding the foundations of credit spreads to effectively managing risk and executing well-timed trades, this guide will equip you with the tools and insights needed for SPX options trading success. Together with InsideOptions, you will gain a comprehensive understanding of the SPX Income Program, empowering you to make informed decisions on your path to consistent options trading income generation.

1. Understanding the Essentials of SPX Credit Spreads

Before diving into the intricacies of credit spread trading with InsideOptions’s SPX Income Program, it is essential to grasp the core concepts related to credit spreads in the realm of SPX options trading:

- Credit Spreads Explained: Familiarize yourself with the basics of credit spread strategies, including the simultaneous buying and selling of option contracts to create a spread with the goal of collecting premiums.

- Call Credit Spreads and Put Credit Spreads: Gain insights into the key differences between call credit spreads and put credit spreads, and understand their respective trading scenarios and strategies.

- High Probability Credit Spreads: Learn the art of constructing high probability credit spreads designed to significantly increase the likelihood of income generation through strategic trade execution.

2. Building a Solid SPX Credit Spread Trading Strategy

Armed with the foundational knowledge of credit spreads, it’s time to explore the components of a successful SPX credit spread trading strategy guided by the expertise of InsideOptions:

- Technical Analysis: Uncover the relevance of technical analysis in crafting an effective SPX credit spread trading strategy, focusing on trend identification, support and resistance levels, and relevant technical indicators.

- Trade Selection: Delve into the process of asset selection, analyzing the intrinsic qualities, extrinsic value, and implied volatility of potential trades to optimize your credit spread transactions.

- Optimal Entry and Exit Points: Discover the importance of choosing optimal entry and exit points for your credit spread trades, utilizing the knowledge of support and resistance levels, trendlines, and option price movements.

3. Effective Risk Management for SPX Credit Spread Strategies

Effective risk management is crucial for long-term success in SPX options trading, ensuring the preservation of your capital and facilitating consistent income generation:

- Position Sizing: Understand the significance of position sizing in SPX credit spread trading strategies, allocating your investment capital appropriately to balance risk and potential rewards.

- Setting Stop Losses and Profit Targets: Learn the intricacies of setting stop losses and profit targets in your credit spread strategies, minimizing potential losses while maximizing profitability from each trade.

- Implementing Hedging Techniques: Enhance your risk management approach by incorporating hedging techniques, such as protective puts and option collars, to safeguard your trades against unfathomable market conditions.

4. Excelling in SPX Credit Spread Trading with InsideOptions’s SPX Income Program

Leverage the expertise, resources, and tools provided by InsideOptions to enhance your SPX credit spread trading experience and generate consistent income:

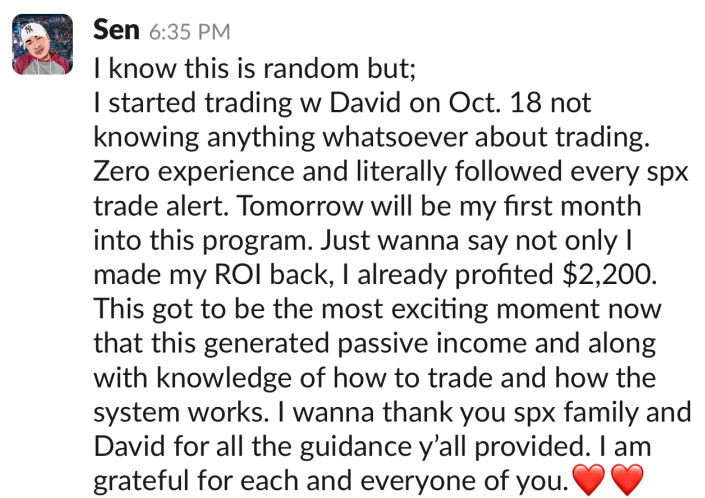

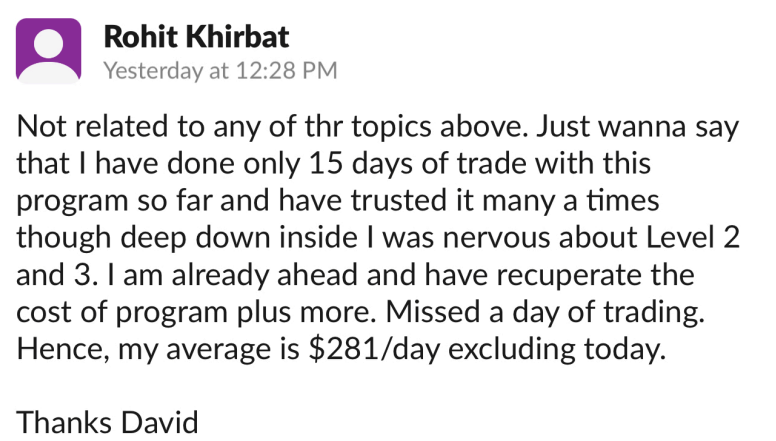

- Expert Guidance: Receive personalized advice, insights, and strategies from experienced professionals, helping you refine your credit spread trading approach and navigate the complex world of SPX options trading.

- Cutting-Edge Tools: Utilize state-of-the-art tools designed to simplify trade analysis, risk management, and execution, empowering you to make informed decisions and execute your SPX credit spread trades with ease and precision.

- Comprehensive Education: Access a wealth of educational resources, including articles, videos, and webinars, to further cultivate your knowledge and skillset in SPX credit spread trading.

Conclusion

Successfully implementing SPX credit spread strategies with InsideOptions’s SPX Income Program can unlock the potential for consistent income generation in the highly competitive world of options trading. By assimilating expert guidance, utilizing advanced tools, and continuously expanding your knowledge and understanding, you can master the art of SPX credit spread trading and achieve a competitive edge in your trading endeavors. With InsideOptions’s support, you can embark on your journey toward long-term success in SPX options trading, ready to seize opportunities and generate consistent income.

Elevate your options trading game with InsideOptions’ SPX Income Program. Gain access to unparalleled expert guidance, advanced trading tools, and comprehensive educational resources designed to help you achieve consistent income generation in the exciting world of options trading. Sign up now for the best options trading services available.