Stock trading can be a daunting task for any beginner. With so many different investment options available, it’s challenging to know where to start. One investment strategy that has gained popularity in recent years is options trading. In particular, call options have become a popular tool for traders looking to increase their profits.

This guide will explain the basics of buying and selling call options and how they can be used to create a successful stock trading strategy:

What are Call Options?

A call option is a contract that gives the buyer the right, but not the obligation, to purchase a stock at a predetermined price (strike price) before a specified date (expiration date). The seller of the call option is obligated to sell the stock at the strike price if the buyer chooses to exercise the option. Call options are often used as a way to speculate on the future price of a stock or to hedge against potential losses in an existing position.

Buying Call Options

When an investor buys a call option, they are betting that the price of the underlying stock will go up before the expiration date. The investor pays a premium to the seller for the right to purchase the stock at the predetermined strike price. If the price of the stock goes up before the expiration date, the investor can exercise the option and purchase the stock at the lower strike price, then sell it for a profit. If the price of the stock does not go up before the expiration date, the investor will lose the premium paid for the option.

Selling Call Options

Selling call options is a strategy used by investors who believe that the price of the underlying stock will not increase significantly before the expiration date. The seller collects a premium from the buyer in exchange for allowing them the right to purchase the stock at the strike price. If the price of the stock remains below the strike price, the option will expire worthless, and the seller will keep the premium. However, if the price of the stock goes above the strike price, the seller will be obligated to sell the stock at the lower strike price, resulting in a loss.

Strategies for Buying and Selling Call Options

There are several different strategies that can be employed when buying and selling call options. One popular strategy is the covered call, which involves selling call options on a stock that the investor already owns. This strategy can be used to generate additional income while also providing some downside protection in the event that the stock price decreases.

Another strategy is the protective put, which involves buying a put option to hedge against potential losses in an existing position. This strategy is commonly used by investors who are bullish on a stock but want to protect themselves against the possibility of a sharp decline in price.

Risks and Rewards of Call Options

Call options offer investors the potential for significant profits, but they also come with a high degree of risk. When buying call options, investors risk losing the entire premium paid if the stock price does not increase as anticipated. When selling call options, investors risk being obligated to sell the stock at a lower price than its current market value if the price of the stock increases significantly.

Conclusion

Call options can be a valuable tool for investors looking to increase their profits and create a successful stock trading strategy. By understanding the basics of buying and selling call options, investors can make informed decisions about when and how to use them.

It is essential to remember that call options come with a high degree of risk and should only be used by experienced investors who are comfortable with the potential for loss. With proper research and a solid strategy, call options can be a powerful addition to any investor’s portfolio.

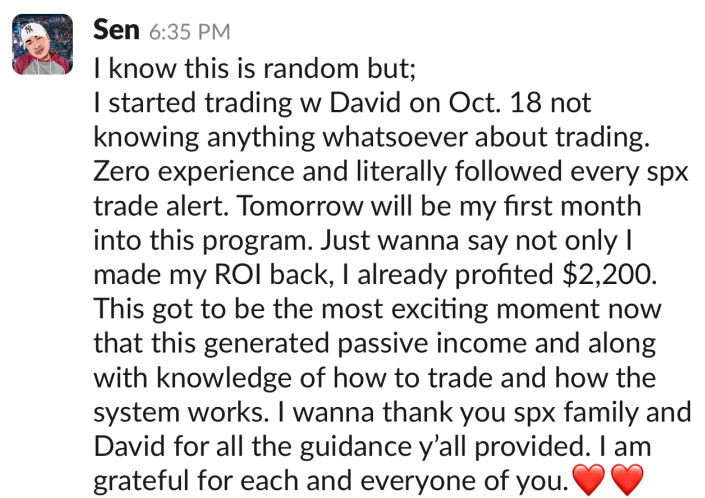

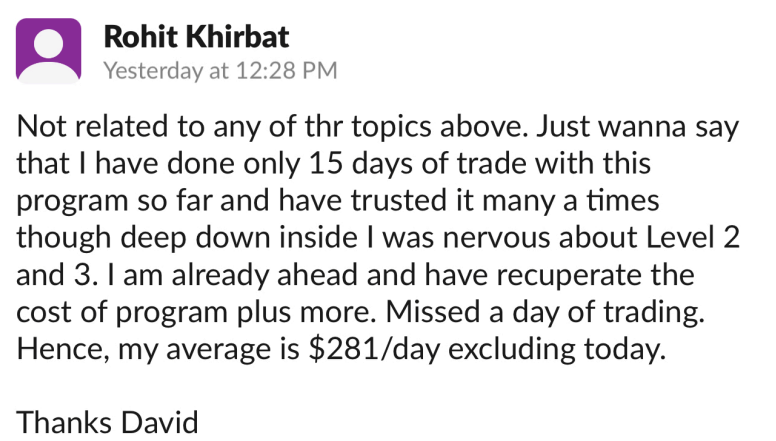

If you are interested in learning about the best ways to make money in trading, contact InsideOptions. We have a perfect record of success by using their own special trading methods. Speak with us today to learn about our stock trading strategy.