Put options are a financial instrument that allows traders to speculate on the price movement of an underlying asset. If you are new to options trading, it can be overwhelming to wrap your head around the various concepts involved. In this article, we will break down the basics of put options, including what they are, how they work, and how to buy and sell them.

What Are Put Options?

Put options are a type of financial contract that gives the owner the right, but not the obligation, to sell a specific asset at a predetermined price within a specified time frame. In other words, put options allow investors to protect themselves against a drop in the price of an underlying asset.

How Do Put Options Work?

Put options work by giving the owner the right to sell an underlying asset at a fixed price, known as the strike price. If the asset price falls below the strike price, the put option owner can sell the asset at the higher strike price, making a profit. On the other hand, if the asset’s price remains above the strike price, the owner of the put option can choose not to exercise the option, and it will expire worthless.

Buying Put Options

When you buy a put option, you are essentially betting that the price of an underlying asset will fall. To buy a put option, you must first decide on the underlying asset you want to trade. It could be a stock, index, commodity, or currency. Once you have decided on the asset, you need to choose the option’s strike price and expiration date.

The strike price is the price at which you have the right to sell the underlying asset. The expiration date is the date on which the option contract expires. It is important to note that the longer the expiration date, the more expensive the option will be.

Selling Put Options

When you sell a put option, you essentially take a bullish position on the underlying asset. You believe that the price of the asset will not fall below the strike price, and you are willing to take on the risk of potentially having to buy the asset if the price falls below the strike price.

Selling put options can be profitable if you are confident in the underlying asset’s price movement. However, it is important to note that selling put options involves significant risk, as you are potentially exposed to unlimited losses if the asset price falls significantly.

Pros and Cons of Put Options

Put options have several advantages and disadvantages that traders should be aware of before entering any positions. Some of the pros of put options include the ability to hedge against a drop in the price of an underlying asset, the potential for high returns, and the ability to trade on leverage. However, some cons of put options include the potential for significant losses, the complexity of options trading, and the need for a deep understanding of the underlying asset and market conditions.

Conclusion

Put options are a powerful tool that can help traders protect themselves against a drop in the price of an underlying asset or profit from a bearish market. However, put options are not without risks, and traders should take the time to fully understand the mechanics of options trading before entering any positions. With the right knowledge and strategy, put options can be an excellent addition to any trader’s portfolio.

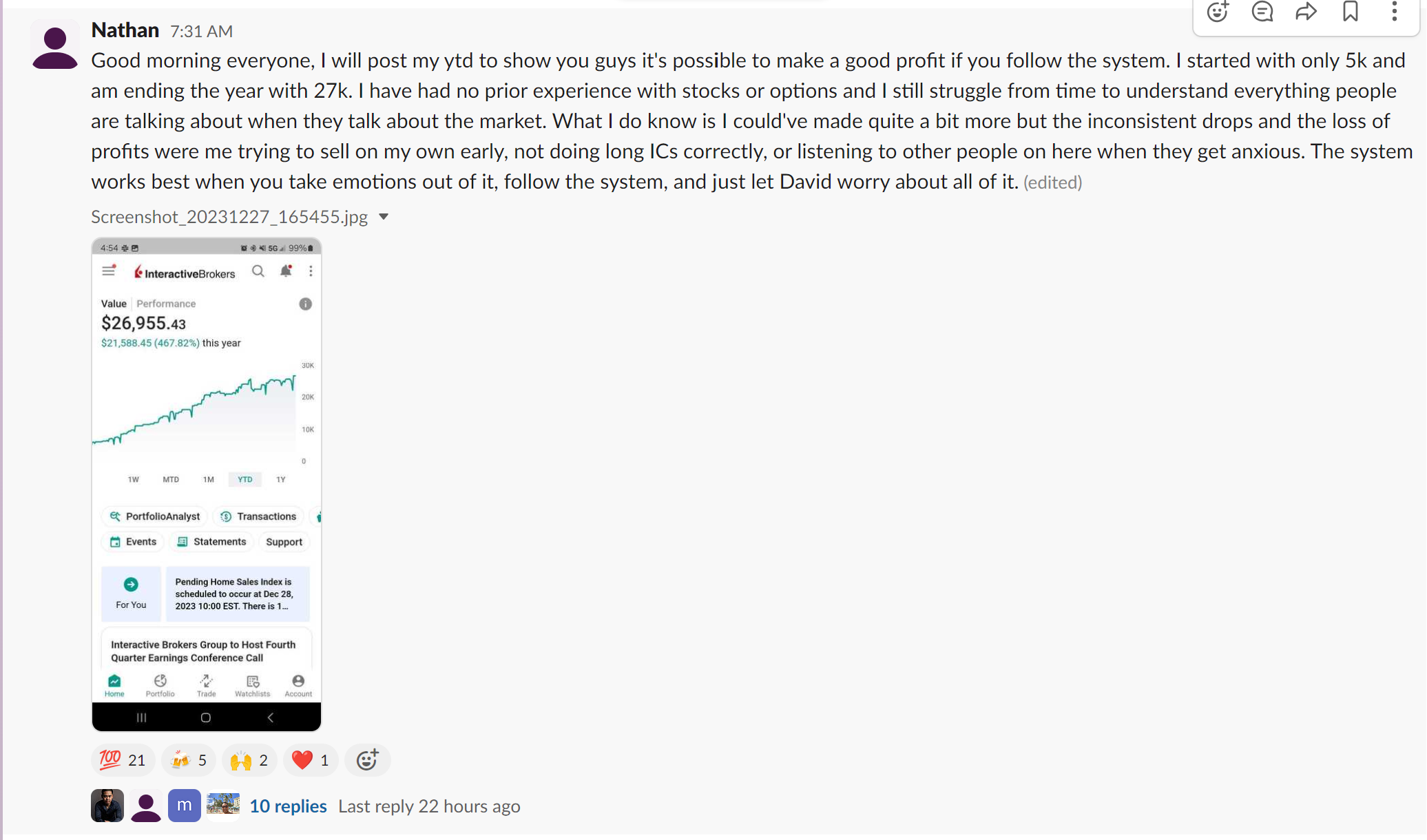

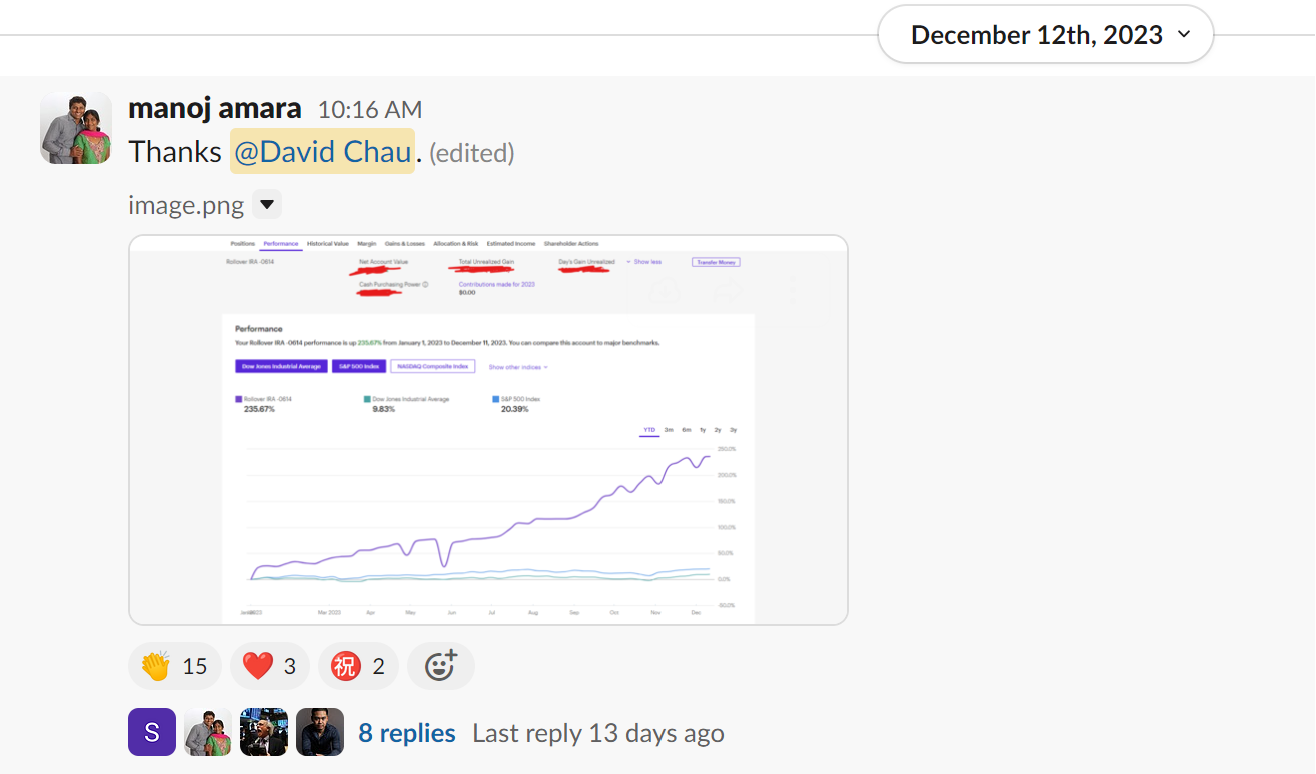

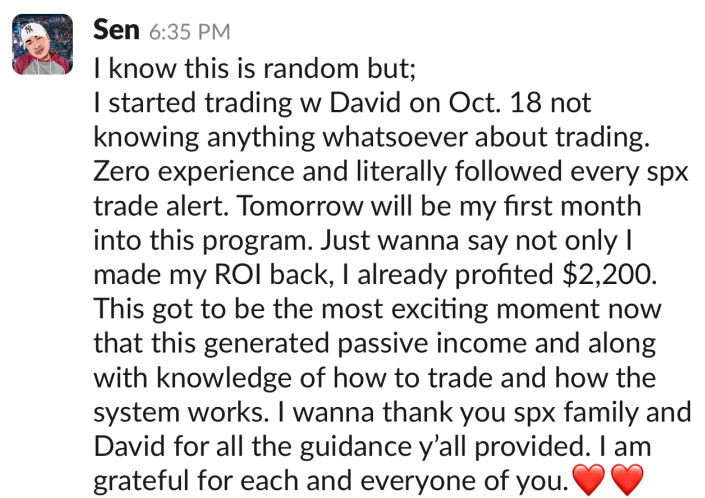

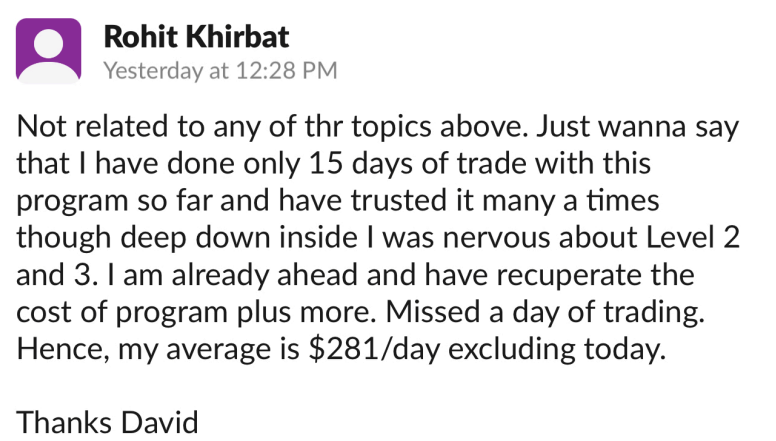

Earn up to $300 daily cash flow using InsideOptions’ Statistical-Based Trading Strategy! Since Inception, we have been able to achieve an outstanding 100% success rate using an advanced series of trades. Our SPX Income Program simplifies trading for experienced and novice traders by doing the work for you. If you want to know how to implement options trading strategies for success, you’ve come to the right place! Enrol with us today!